General Information

Subject Area: Mathematics (B.E.S.T.)

Grade: 912

Strand: Financial Literacy

Date Adopted or Revised: 08/20

Status: State Board Approved

Benchmark Instructional Guide

Connecting Benchmarks/Horizontal Alignment

Terms from the K-12 Glossary

Vertical Alignment

Previous Benchmarks

Next Benchmarks

Purpose and Instructional Strategies

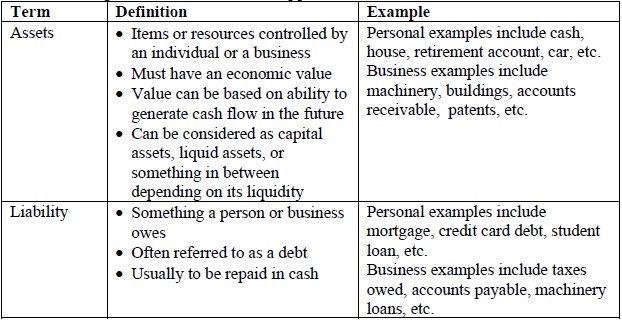

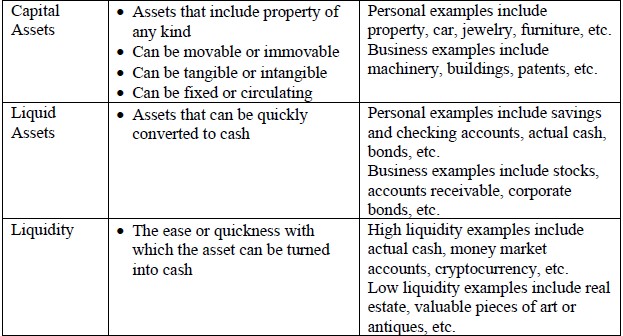

In middle grades, students became fluent in operations with rational numbers and solved problems involving money. In Algebra 1, students worked with data in tables and graphs involving rational numbers. In Math for Data and Financial Literacy, students gain understanding of net worth for individual planning and for business.- The following terms are used for the application of this benchmark:

- Net Worth is determined by the difference of assets and liabilities.

- Instruction includes a variety of asset possibilities that could be included such as a value of home, car, computers, stocks, bonds, checking and savings accounts. Liabilities should include examples such as home mortgage, car payments, student loans and credit card debt.

Common Misconceptions or Errors

- Students may have misconceptions of what can be considered an asset beyond money or bank accounts, such as a valued collection or money in retirement accounts.

- The term liability should be discussed as it may be a new concept for students. Discuss items that can be a liability including debt that comes from other items beyond just living expenses.

Instructional Tasks

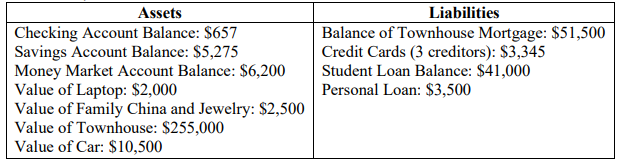

Instructional Task 1- Belinda is planning to move to Tampa for a job. She owns her car and has been working on paying off the townhouse and will need to make decisions on selling them to move. As she is planning, she wants to determine her net worth. Using the chart below of her major assets and liabilities, determine her net worth.

- Part A. Create a spreadsheet showing Belinda’s liabilities and assets and compute Belinda’s net worth.

- Part B. What recommendations would you make to her if she wants buy a new condo in Tampa that will cost $175,000, without taking out a new mortgage, and maintain assets of at least $10,000.

Instructional Task 2

- A start-up company that develops online games is working with their accountant to begin a budget for the next three years. Develop a list of items that the company could consider to be their capital assets and their liquid assets, and include potential values that would represent each item.

Instructional Items

Instructional Item 1

*The strategies, tasks and items included in the B1G-M are examples and should not be considered comprehensive.